Are Your Ministerial Earnings Covered Under FICA or SECA?

- landmarktaxservice

- Oct 7, 2020

- 1 min read

Updated: Nov 2, 2020

Ministerial earnings are the self-employment earnings that result from ministerial services. As a minister, you can be covered under either FICA or SECA. Here’s the rundown on what each tax system is, which system your earnings fall under, and what additional taxes you may need to pay.

What is FICA and SECA?

Three federal taxes are paid on wages and self-employment income—income tax, social security tax, and Medicare tax. Social security and Medicare taxes are collected under one of two systems. Under the Self-Employment Contributions Act (SECA), the self-employed person pays all the taxes. Under the Federal Insurance Contributions Act (FICA), the employee and the employer each pay half of the social security and Medicare taxes. No earnings are subject to both systems.

Which system’s got you covered?

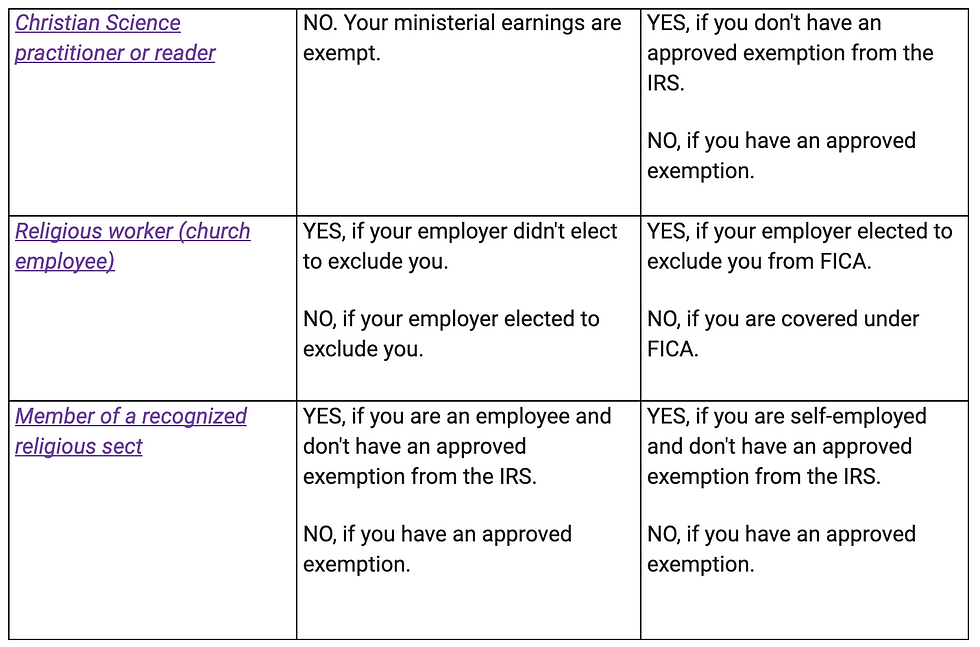

Find the class to which you belong in the left column and read across the table to find if you are covered under FICA or SECA. Don't rely on this table alone. You can get a more detailed explanation of these tax systems on the IRS website.

Additional Medicare Tax

In addition, all wages and self-employment income that are subject to Medicare tax are subject to a 0.9% Additional Medicare Tax to the extent they exceed the applicable threshold for an individual's filing status. Additional Medicare Tax applies to Medicare wages, RRTA compensation, and self-employment income that are more than:

$125,000 if married filing separately,

$250,000 if married filing jointly, or

$200,000 for any other filing status.

For more resources on taxes relating to your services towards the church, talk to the trusted tax and finance experts at Landmark Tax.

Comments